LA MARKET FORECAST

10/14/2022

Let's talk about what's going on in the residential real estate market. Today, the topic of conversation is fear. Fear of rate hikes, fear of the coming economic recession, fear of inflation and international unrest. As Churchill beautifully put it: "Fear is a reaction, courage is a decision."

If history has taught us anything, it is that everything moves in cycles. Rates fall and they rise and they fall again. The economy and housing markets are no different. As evidenced time and again, real estate in Los Angeles has proven to be an excellent investment for appreciation over the long term.

After a hot start to the year, the third and fourth quarter home sales have sharply tapered off. Home sales could be down 15 percent by the end of the year. Yet unlike the run-up to the 2008 crash, the current supply of available homes remains very low. Limited inventory is acting as a hedge so that prices are not expected to drop the way they did in 2008. The vast majority of loans written over the past decade have been fixed rate, so there is no impending slew of defaults coming, as they did with ARMs post 2008. Also, Millennials are expected to drive continued demand for homes in the coming years.

Today's market is becoming a buyer's opportunity market. The owners who are selling are generally trying to realize some long term appreciation or are dealing with a major life event, such as a death in the family, divorce, downsizing or relocation. The opportunity lies with the sellers who need to sell. We are seeing price reductions across the board and with decreased buyer demand, sellers are often negotiating only one offer, which gives buyers leverage. There is an opportunity to "test the market" and see what deals are available with well "under-ask" offers. You may be surprised how much flexibility there is today.

And with a lower purchase price, you have options. You can buy down points on the loan to reduce your monthly payments, request the seller buy down your points, or simply deal with higher monthly payments for 18-24 months and then refinance when rates are in the 4 percent range. Either way, you will build equity faster than the buyer who bought earlier this year and profit more when you eventually sell, making the purchase a smart long term financial decision. find out with our buyer's guide by Adam Brawer

Remember, you can always refinance your home loan when rates improve, but you can never renegotiate your purchase price.

If you have any real estate questions, call or text me: (310) 279-8259

All the Best,

Adam

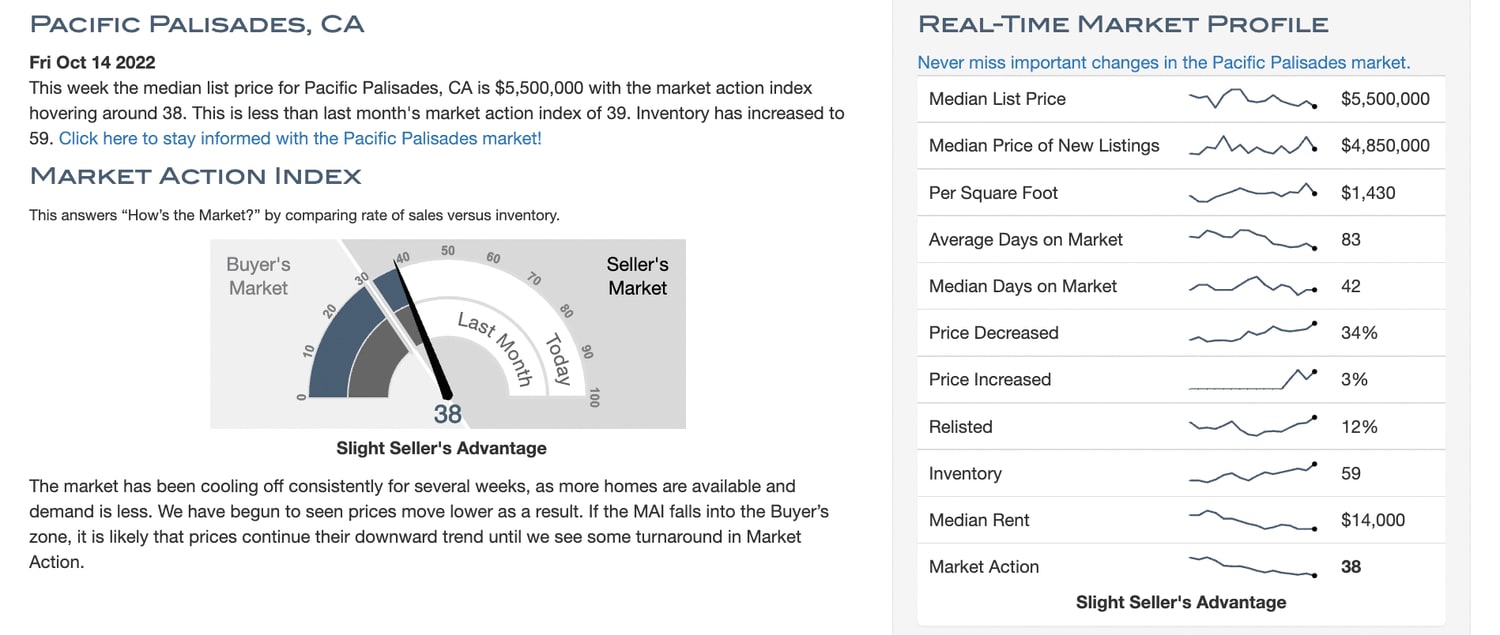

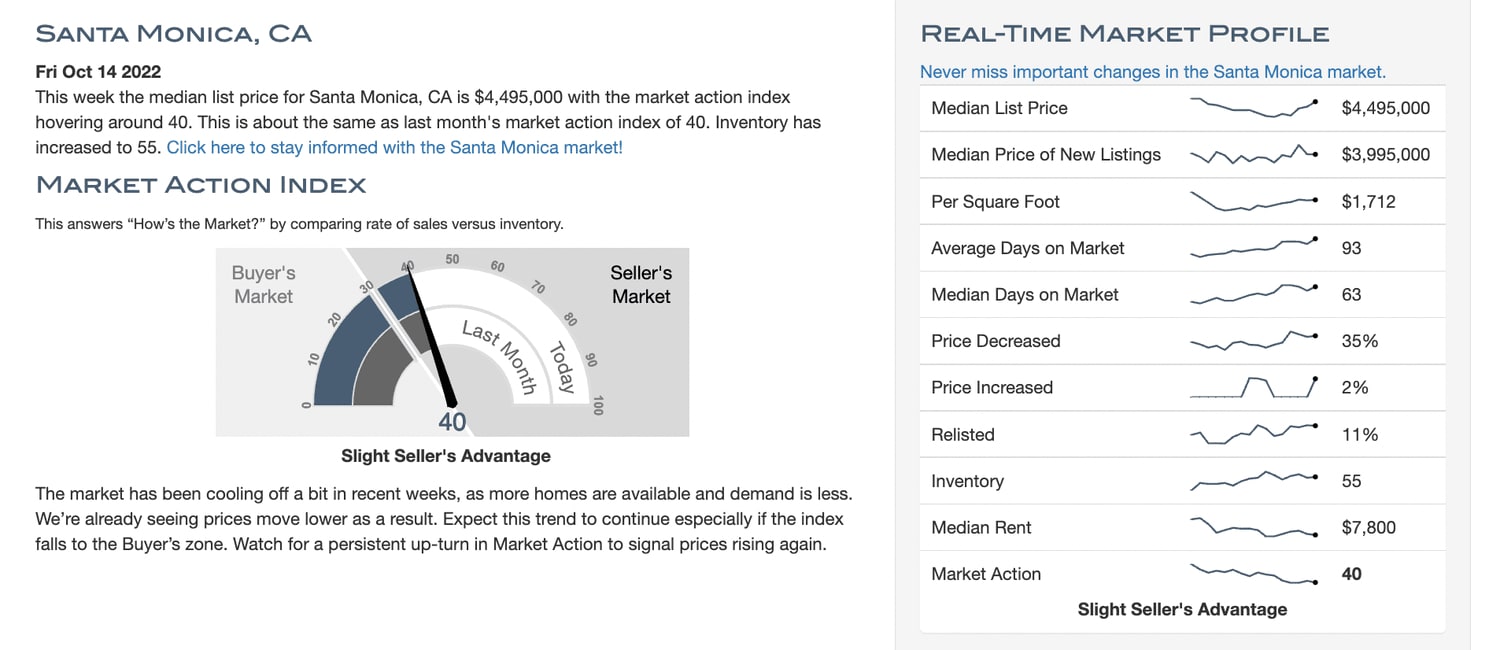

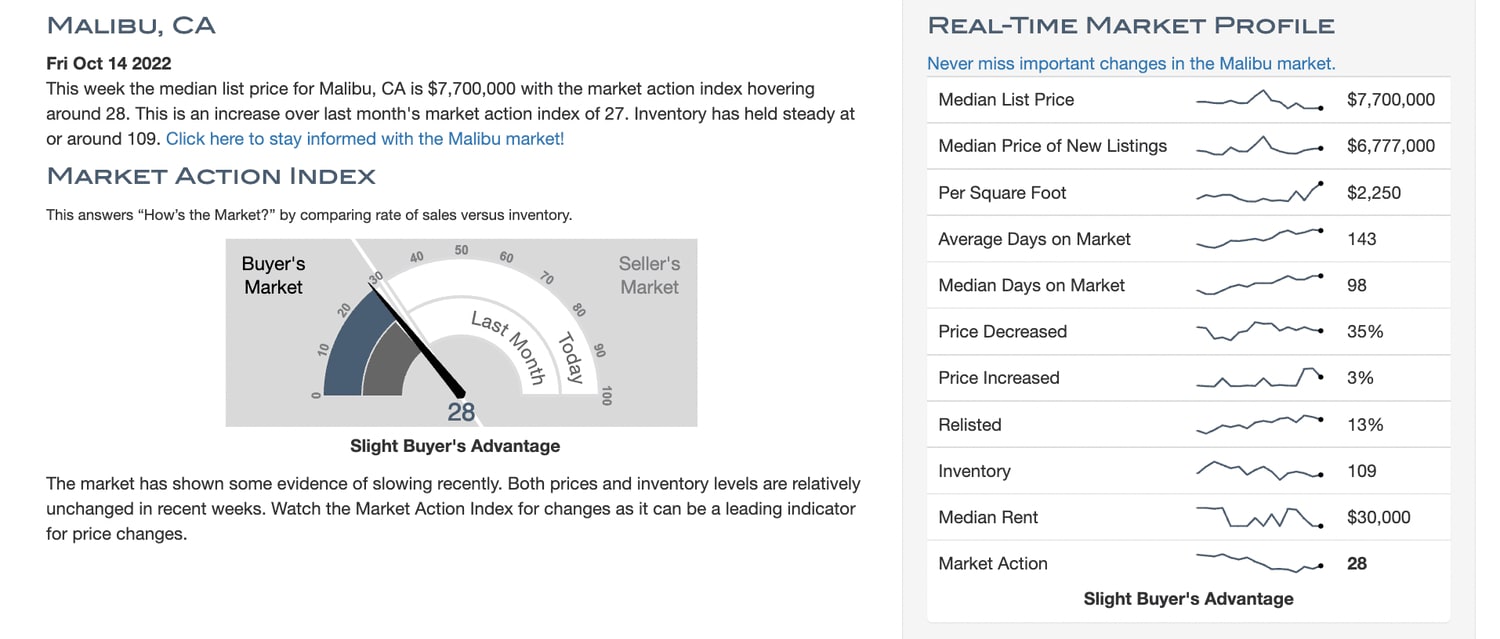

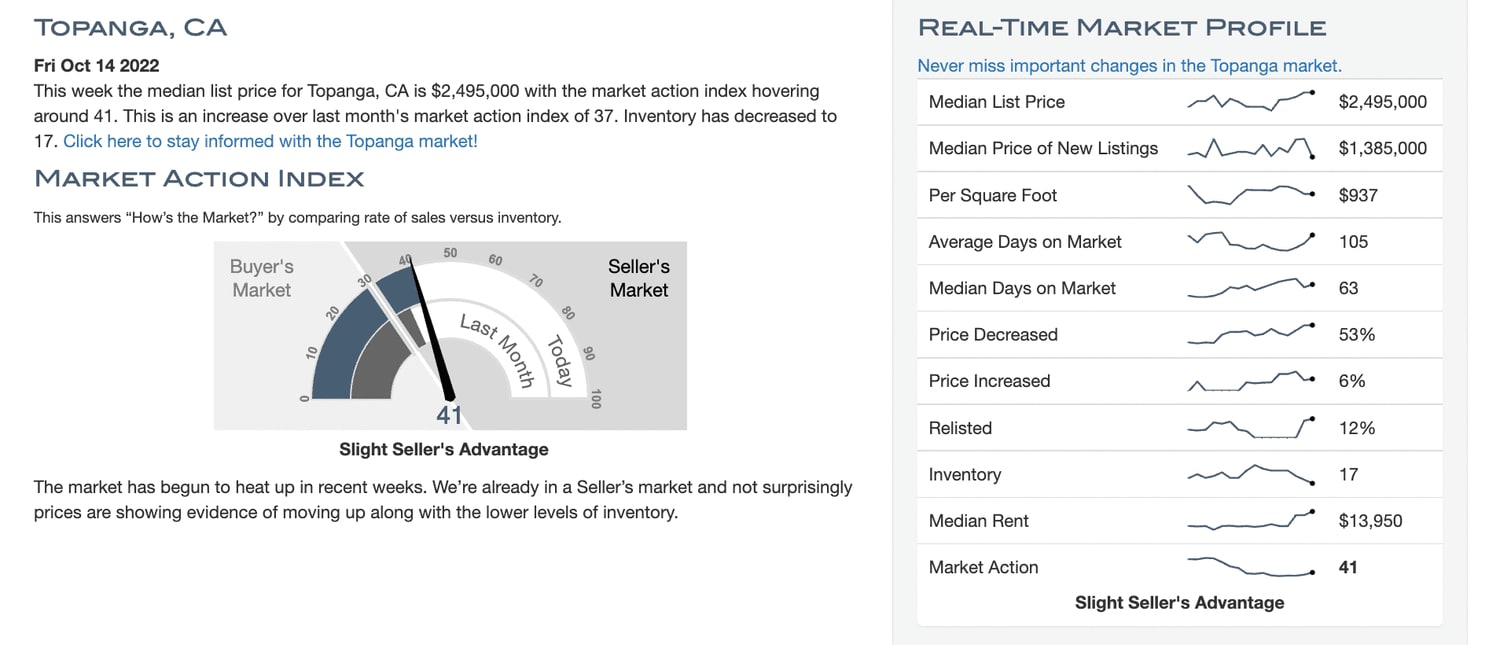

WESTSIDE MARKET STATS:

Message me if you have questions about your specific neighborhood.