END OF SEPTEMBER MARKET + ECONOMIC UPDATE

9/23/2022

Mortgage demand is on the rise! What, you may say?!Yes, this is actually true. For the first time in 6 weeks, mortgage applications have gone up this week, as have applications to refinance homes. While they've gone up, they're still sharply down from this time last year when interest rates were spectacularly low and buyers were clamoring to get their hands on a home.

Today the average 30 year fixed mortgage rate is hovering around 6.25%. This is roughly double what it was at its lowest. And yet, this rate is actually lower than the average rate over the past 30 years, to put things in context. Guess the average 30 year fixed rate in 1981 nearly 18%.

One thing I like to tell friends and clients is that while rates are on the rise, they're not on the rise for 30 years. Generally, when rates go up, prices go down. And we're seeing lots of price reductions across the board, as the market corrects from record breaking highs. This correction is a good thing; it's stabilizing the market.

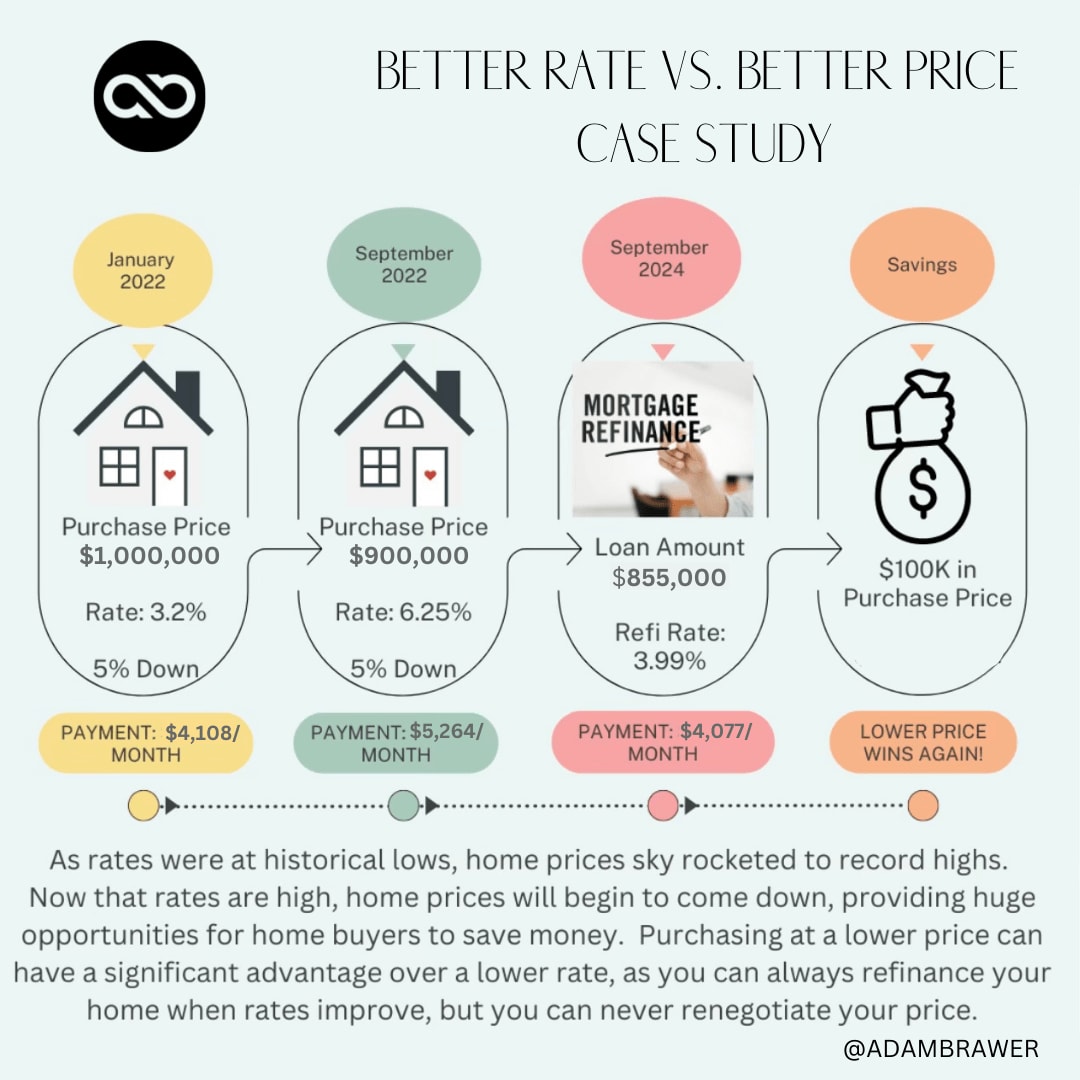

Below you'll see an infographic that depicts why there's real opportunity in the market at this time:

For sake of round numbers, let's say you bought a $1M home in January, at a 3.2% interest rate, putting 5% down. You'd be paying roughly $4100 per month (not including taxes or insurance).

Again, for sake of simplicity, let's say that home today sells for $900K. Reason being: buyer demand has dropped sharply. And rather than heated bidding wars, homes are selling with one offer, or maybe a few on the table. Buyers are no longer making emotional decisions and driving prices sky high. So assuming you were to get that same home today, for $900K with 5% down at a 6.25% interest rate, you'd be paying roughly $5265 per month (not including taxes or insurance).

Now let's say you live in the home for two years, and enjoy tax deductions for property taxes and interest payments, which help to greatly offset your personal taxes to the tune of tens of thousands of dollars per year. (Better than burning cash on a high priced rental each year...)

It's now September 2024, and interest rates have gone down, as economists and Goldman Sachs are predicting. And you decide to refinance to take advantage of lower interest rates. Let's assume you haven't even paid off $1 of principal, and your loan amount is still $855K ($900K - 5%). At a 3.99% interest rate, you'd be paying roughly $4,080 per month. Forget about the $20-30 per month you're saving. While we all love buying an elixir at Erewhon, that money doesn't matter.

Let's talk about the $100K you saved!

You're now in a far better position than the buyer who was approved for a 3.2% interest rate in January. And when the property appreciates, as it has following every single market correction, you will build equity much faster and ultimately make more money on your eventual home sale.

Let's say you sell in September 2027 for $1.3M. You now have $400K in equity, as opposed to the buyer who "only" has $300K. Not bad!

Remember, you can always refinance your home loan when rates improve, but you can never renegotiate your purchase price.

If you have any real estate questions, call or text me: (310) 279-8259

All the Best,

Adam

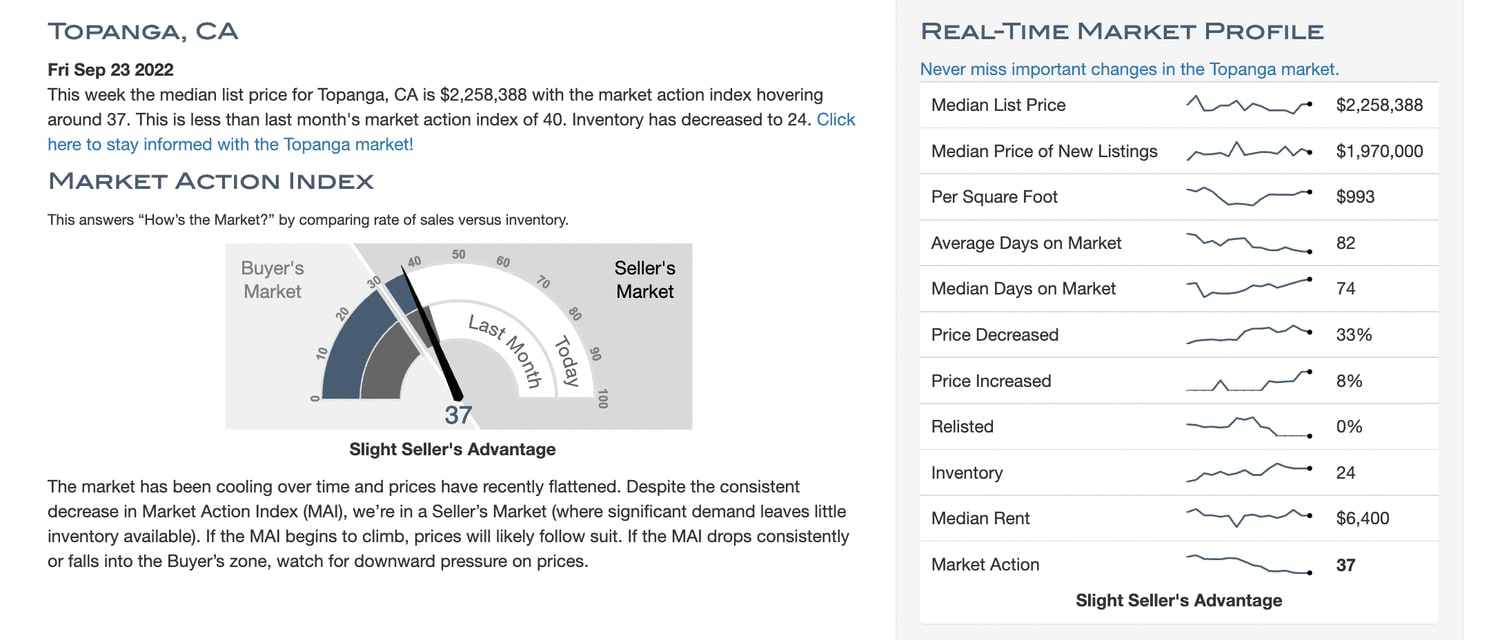

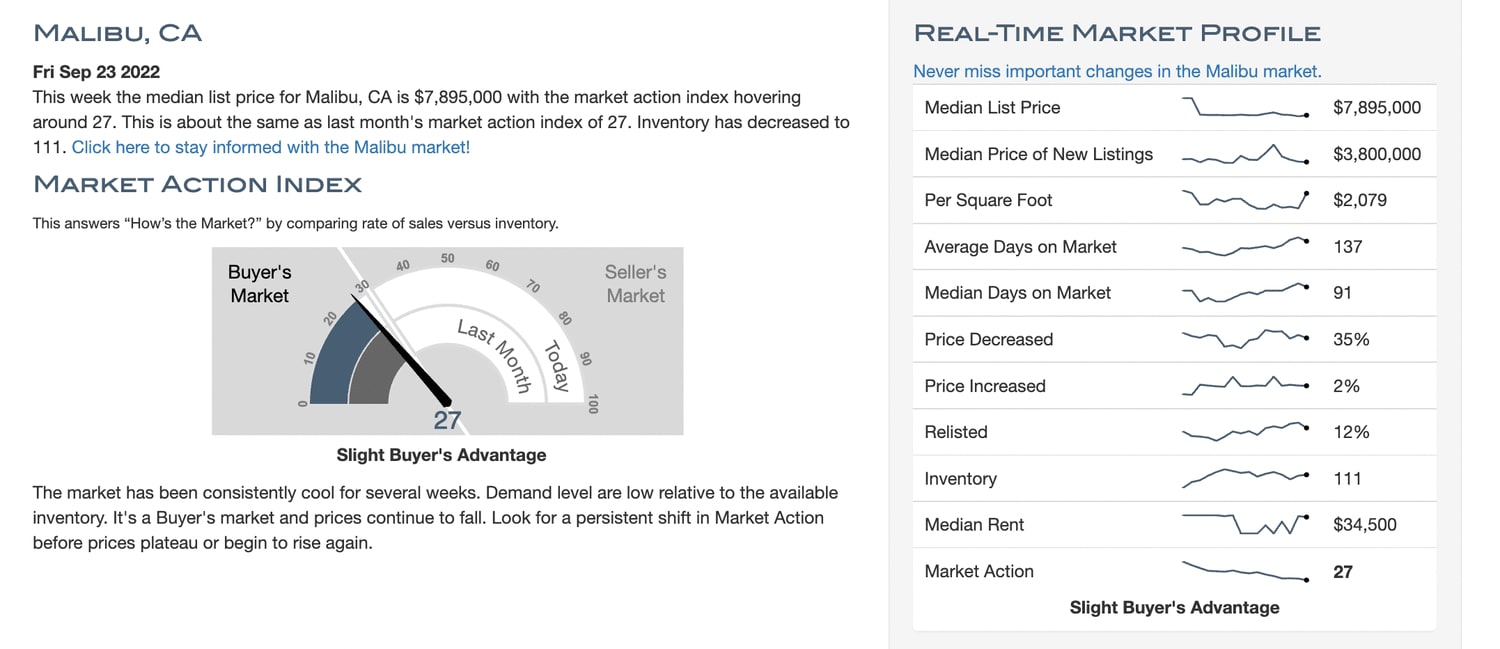

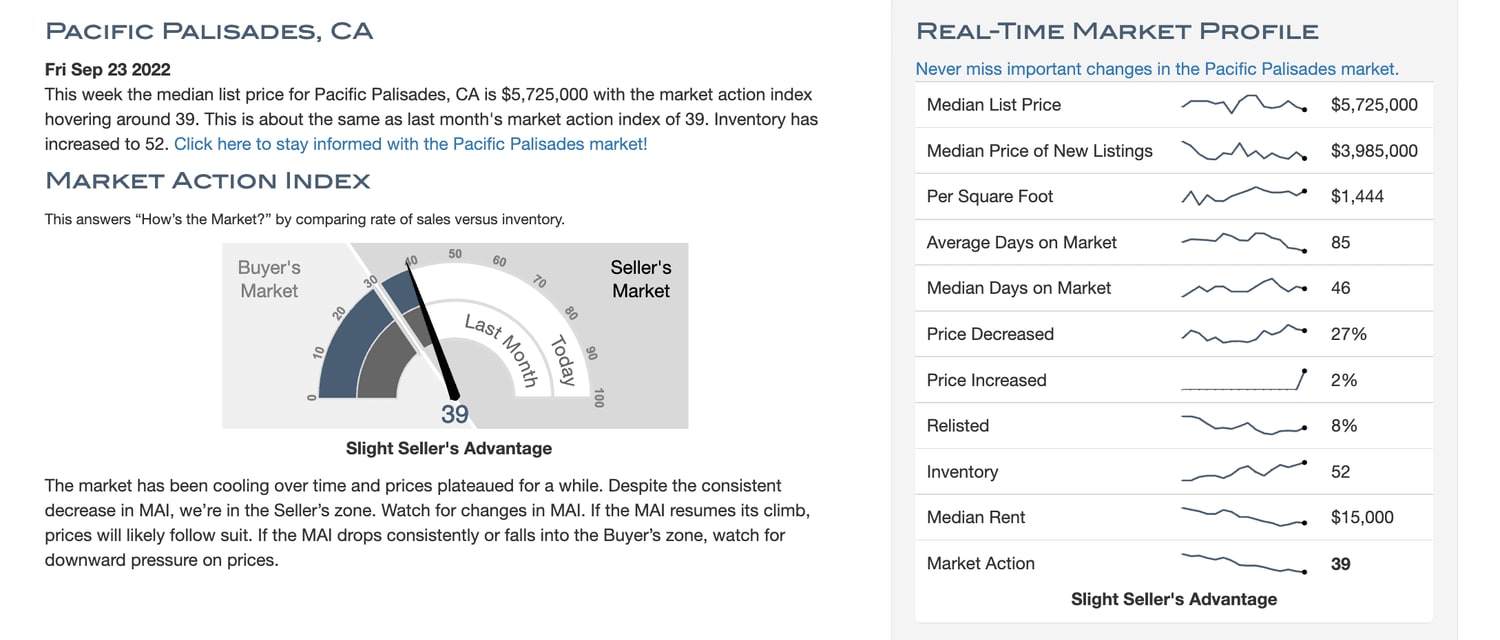

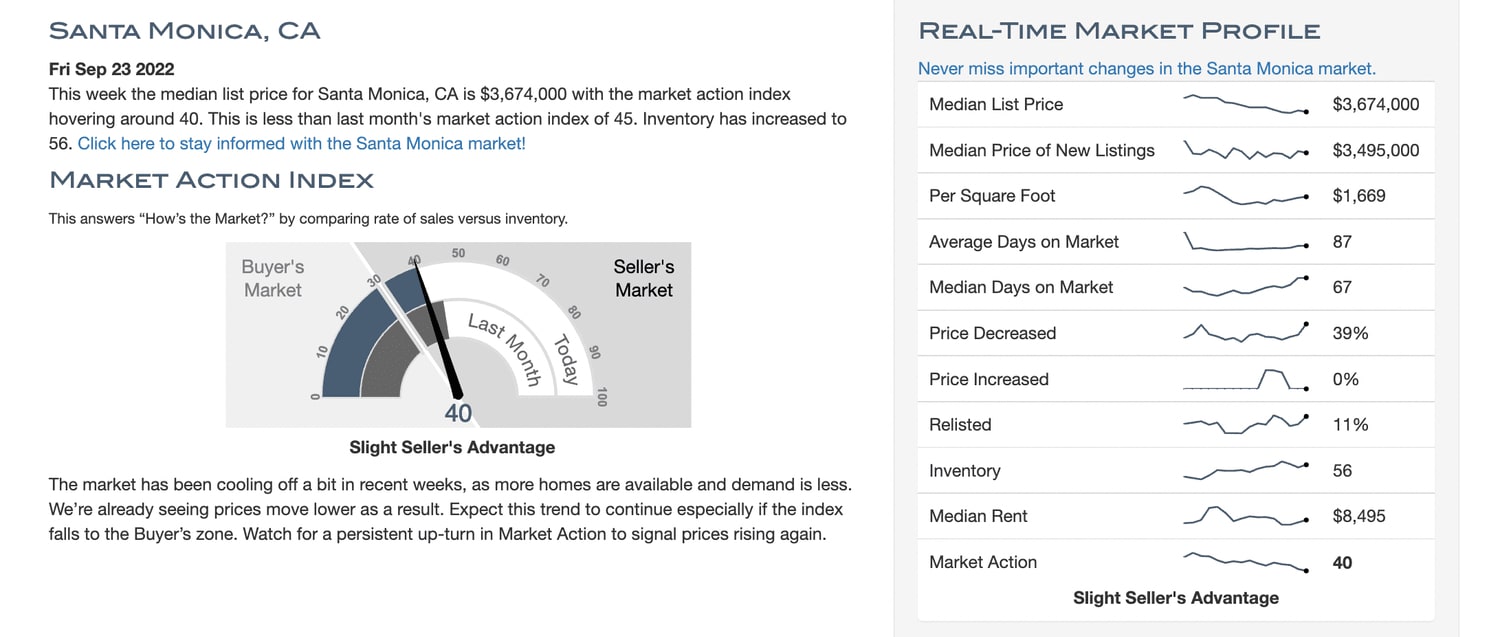

WESTSIDE MARKET STATS:

Message me if you have questions about your specific neighborhood.

END OF SEPTEMBER MARKET + ECONOMIC UPDATE

Mark, the Founder of AllOneWealth, and I, are excited to provide an economic update with valuable information, industry insight, and professional guidance on the latest key trends.

Interested in learning more about markets, inflation, QE or how you can take advantage of current investment opportunities? Schedule a call with us.

Warmly,

Adam

NATIONAL 30-YEAR FIXED MORTGAGE RATES GO UP TO 6.30%

The current average 30-year fixed mortgage rate climbed 17 basis points from 6.13% to 6.30% on Friday, Zillow announced.

The 30-year fixed mortgage rate on September 23, 2022 is up 42 basis points from the previous week's average rate of 5.88%.

MARK'S TAKE ON THE STATE OF THE ECONOMY:

Headlines reading the same story, folks: Recession impending and inflation is ramped.Yet I’m still of the mind that we are seeing progress in the way of inflationary data. And, we’re already in a recession – a recession doesn’t have to look like a 2008 event – so don’t let them tell you the sky is falling. It has already fallen! The Fed is doing it’s work to turn the ship and the economy may be a little more bumpy in the coming months. However, it’s still my opinion that we’ll see market conditions shift positively in Q4.

All the best,

Mark